AMR Director Accused of Insider Trading

You are the Company You Keep

AMR director accused of insider trading

BusinessWeek

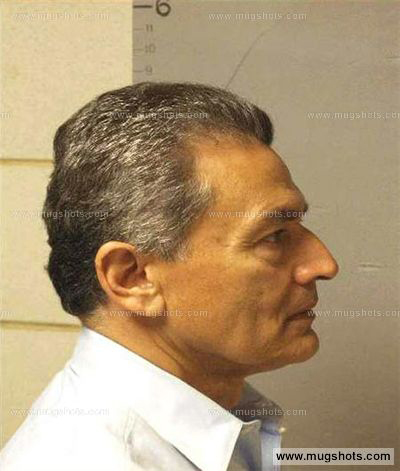

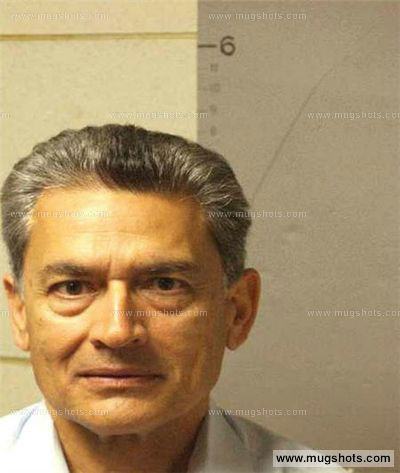

DALLAS - A former Goldman Sachs director accused by the government of insider trading remained on the board of American Airlines parent AMR Corp. on Tuesday.

The Securities and Exchange Commission accused Rajat K. Gupta of tipping off a hedge fund manager that Warren Buffett's Berkshire Hathaway planned to invest $5 billion in Goldman and providing information about the bank's 2008 financial results before they were made public.

Through a spokesman, AMR declined to comment about Gupta, who was still listed as a director on the airline-company's website Tuesday afternoon.

AMR's code of conduct warns against insider trading, saying it is "unethical and illegal, and will be dealt with decisively."

Gupta was elected to the AMR board in 2008. At the time, AMR CEO Gerard Arpey said Gupta and another new director brought "diverse points of view and personal qualities that will help strengthen both AMR and American now and in the years to come."

Gupta was an executive for management-consulting firm McKinsey & Co. until he retired in 2008 around the time he joined the AMR board. He left the Goldman board in May 2010. He also served as a director at consumer-products giant Procter & Gamble and other companies.